Improving your credit score might seem like a daunting task, but it plays a crucial role in your financial life. A good credit score can significantly lower your expenses when borrowing money, make it easier to rent a home, and sometimes, can even influence your job prospects. Whether you’re preparing to apply for a mortgage, or you just want to improve your financial health, boosting your credit score can be done with a few strategic moves.

In this post, we delve into ten straightforward, actionable ways to lift your credit score, ensuring you’re seen in the best possible light by lenders, landlords, and employers.

Understand Your Credit Score and Its Importance

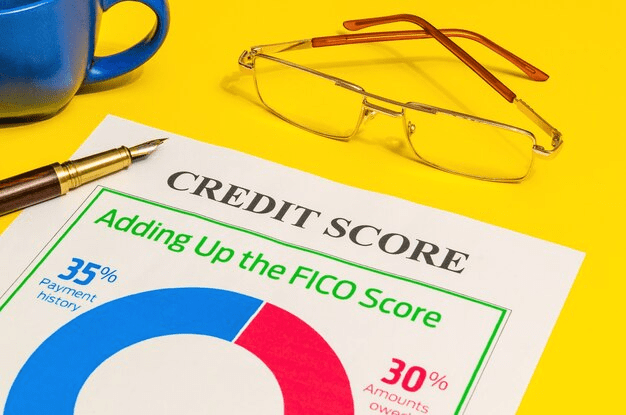

Before diving into the tips, it’s essential to grasp what your credit score is and why it matters. Your credit scores are calculated using the information in your credit reports. This score indicates to lenders how reliable you are likely to be in repaying debts. Scores can range from 300 to 850, and typically, a score above 700 is considered good.

1. Check Your Credit Report for Errors

Your credit report is the foundation of your credit score. carefully review your credit report to identify any mistakes or inaccuracies that could be negatively impacting your credit score. If discrepancies are found, one should file a dispute with the relevant credit bureau, as they are legally obligated to investigate and correct any errors within 30 days. This is one of the quickest ways to see an improvement in your credit score is by fixing errors in your credit report.

- Review Your Credit Reports: Obtain a free copy of your credit reports from major credit reporting bureaus—Equifax, Experian, and TransUnion. You are entitled to one free report from each bureau every year via AnnualCreditReport.com.

- Identify Any Errors: Look for errors such as incorrect personal information, duplicated accounts, inaccurate account statuses, and erroneous records of late payments.

- Dispute the Errors: If you find any discrepancies, file a dispute with the corresponding credit bureau. They are legally obligated to investigate the issues within 30 days.

2. Pay Your Bills on Time

Maintaining a tremendous payment history is important for a healthy credit rating, as it carries considerable weight in determining your typical creditworthiness, accounting for up to 35% of your general rating. Timely bills show lenders that you are a responsible borrower who can manipulate credit responsibly. To keep away from lacking bills, don’t forget to use gear along with setting up fee reminders in your calendar or the use of car-pay functions furnished by lenders. By proactively dealing with your fee schedule, you may set up a solid track file of on-time bills, that can have a long-lasting high-quality effect on your credit profile.

- Timely Payments: Even payments that are late by a few days can be reported to the credit bureaus.

- Get Current on Outstanding Debts: If you’re behind on any payments, catching up on them as soon as possible is vital. Once your payments are current, the positive data from paying bills on time may help improve your credit score.

3. Reduce Your Credit Utilization Ratio

Lowering your credit usage ratio is vital for preserving a healthy credit rating because it plays a large function in determining your average creditworthiness. Your credit score usage ratio refers to the quantity of credit scores you’ve used in comparison to the overall credit available to you. This metric holds enormous weight in credit score calculations, making up approximately 30% of your FICO score. To improve this ratio, take into account paying down current balances, asking for a credit score to restrict growth, or spreading out your spending throughout more than one credit score account.

- Keep Your Balances Low: Try to keep your overall credit usage below 30%. For instance, if you have a credit card with a $10,000 limit, you should try to keep your ongoing balance below $3,000.

- Increase Your Credit Limits: Asking for a higher credit limit might help decrease your utilization ratio, provided you don’t increase your spending.

4. Avoid Opening Several New Credit Accounts Simultaneously

Opening a couple of new credit bills concurrently can have a poor impact on your credit score score and notion through creditors. Each time you observe a new credit account, a difficult inquiry is generated in your credit score record, which could result in a mild lower in your credit score rating. Additionally, having more than one difficult inquiry inside a quick time frame can signal to lenders that you are actively looking for a credit score, doubtlessly indicating monetary instability or a higher threat of default. This perception of danger can make creditors hesitant to increase extra credit or provide favorable terms.

- Space Out Your Applications: If you need to open a new account, be strategic about the timing to minimize the impact on your score.

5. Maintain a Diverse Set of Credit Accounts

Credit mix—the different types of credit accounts you have—also affects your credit score, though to a lesser extent. Lenders like to see a variety of credit types because it indicates that you can handle different types of credit responsibilities.

- Manageable Diversity: This could include a mix of credit cards, a mortgage, or an auto loan. However, only diversify if it makes financial sense for you.

6. Keep Your Old Credit Cards Open

Because your credit history affects your FICO score, it may be advantageous for your credit score to keep your previous credit card open. Your credit evaluation is significantly influenced by the duration of your credit history, which makes up approximately 15% of your FICO score. It can lessen your credit history overall to close old credit cards, especially those with no annual fees. Your credit score may be negatively impacted by this shortening of your credit history since it may suggest to credit bureaus that you lack experience managing credit ratings. Furthermore, canceling an old credit card will lower your credit availability overall, which could result in high loan utilization and a bad credit score.

- Keep Cards Active: If the older cards have no annual fee, keeping them open and using them sparingly can benefit your credit score.

7. Pay Off Debt Instead of Moving It Around

Using balance transfers and opening new accounts to move debt around can hurt your score more than it helps. Paying off debt simply by transferring funds or opening a new account is a highly effective long-term strategy for improving your financial health. Focus on genuinely paying down your debt. By really focusing on reducing your debt, you can continue to improve your credit score over time.

- Apply Extra Payments to Your High-Interest Debts First: This approach not only helps your credit scores but also saves you money on interest in the long run.

8. Become an Authorized User

Becoming an authorized consumer on a member of the family’s credit account may be a strategic move for people with confined credit records or those seeking to rebuild their credit score. By piggybacking on a person else’s credit history, you could potentially benefit from their fine monetary behavior. It’s critical to choose a primary account holder with a track document of making well timed bills and retaining low credit usage. This strategy permits you to set up or improve your credit score profile, as the primary account holder’s responsible credit score management displays positively for your very own credit score report.

- Communicate Effectively: Being an authorized user means the primary holder’s credit habits directly impact you – both positively and negatively.

9. Limit Hard Inquiries

Limiting hard inquiries on your credit file is essential for maintaining a healthy financial standing. When you apply for credit, such as a mortgage or credit card, a hard inquiry is generated, which can temporarily impact your credit score. To minimize the negative consequences of these inquiries, it’s advisable to confine rate-shopping for loans like mortgages or student loans to a brief period. By conducting your comparison shopping within a compressed timeframe, typically around 14-45 days, credit bureaus may consider multiple inquiries for the same type of loan as a single inquiry, thereby lessening the potential adverse effect on your credit rating.

- Strategic Applications: Space out applications for credit cards, auto loans, and other forms of credit to reduce the number of hard inquiries.

10. Monitor Your Credit Regularly

Staying informed about your credit status gives you the power to manage it effectively. Many services and credit card companies offer free credit score tracking, which can alert you to changes in your score, helping you to act swiftly should something appear off.

- React Promptly: Identifying and addressing issues as they arise keeps you on track toward improving your credit score.

Conclusion

Improving your credit score does not have to be an overwhelming process. By implementing the tips provided, you’re taking meaningful steps towards lifting your credit score quickly and sustaining it. Remember, each small step can significantly improve your financial well-being, paving the way for more favorable loan terms and credit opportunities. Stay persistent, monitor your progress, and continue educating yourself on financial health to maintain a robust credit score. Keep in mind that improvements won’t happen overnight, but with consistency, you’ll see your efforts pay off!

Pingback: Get Your Free Credit Report in less than 10 Minutes